China is probing the loan practices of a group of big private sector conglomerates who have been on a high-profile global spending spree over the past few years.

And although the review targets only a few of the country’s most politically-connected companies, some analysts see an attempt to increase government control over the role played by the private sector in foreign markets.

"I think this is an attempt to change the direction (of) the role these Chinese companies play in the Chinese economy," says Paul Gillis, a professor at Peking University's Guanghua School of Management. "To align them more closely with the policies of the government and to reduce the risks that actions of these private companies could end up having a shock effect on the economy as a whole."

Chinese authorities say they launched the probe because of worries that highly leveraged overseas deals pose risks to China's financial system. Officials have already expressed worries over mounting debt among Chinese lenders, some of which may remain hidden by China's opaque lending networks.

Notable companies targeted

According to media reports, the list of companies under review is a relative who’s who of Chinese enterprises.

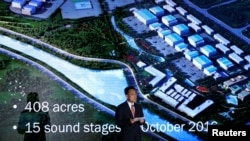

Among those reportedly targeted are Dalian Wanda, which owns the AMC Theaters chain in the United States and has been actively courting deals in Hollywood. High-flying insurance company Anbang, which owns New York’s Waldorf Astoria and Essex House hotels. Also on the list is Hainan Airlines, which bought a 25 percent stake in Hilton Hotels last year and another insurance company Fosun, which owns Cirque de Soleil and Club Med.

Over the past few years, China has seen massive amounts of capital moving overseas with companies and wealthy individuals buying assets abroad. Authorities began taking steps late last year to tighten controls. But many big conglomerates view foreign investment as a golden opportunity – given the low global interest rate environment – and worth the risk of highly-leveraged investments.

Peking University's Gillis says it appears the Chinese government is coming to terms with how to effectively regulate private enterprises, companies that behave more aggressively than their state-owned counterparts. But he also sees the move as a further consolidation of power by President Xi Jinping, bringing companies more under the control of the central government.

"I think many of the companies had a pretty favorable treatment from prior administrations, and I think Xi Jinping is less enamored of these large private companies than some of his predecessors were."

Expensive acquisitions by companies like Wanda and Anbang have thrust China into the global spotlight. But the news and commentary that followed the companies' mega-deals has not always been positive.

In some cases, the deals have given China a black eye, says Fraser Howie, author of the Red Capitalism: The Fragile Financial Foundation of China's Extraordinary Rise. Anbang’s attempt last year to purchase Starwood Hotels is one example, he says.

"This is high profile, global Bloomberg headline, Chinese company buys Starwood Group, next week it’s all off because the funding was never there, the due diligence could never be completed there, it made all Chinese bidders look horrible," said Howie. "It looks dreadful for the party and for the leadership that these private entrepreneurs are running out there and yet China as a country is being impacted by it."

Earlier this month, the head of Anbang was the latest to be swept up in the ongoing financial crackdown.

Regulating private spending?

Authorities so far have not said specifically what the targeted companies may have done wrong, if anything. Some analysts argue that the probe is just a part of a process that began six month ago to curtail the flight of capital from China.

"If cross-border M&A deals make sense, if they deliver strong returns, then there should be no problem either for bankers or those doing the buying. But, if Chinese groups overpay and get the money to do so from Chinese banks providing risky or underpriced loans, then Chinese regulators have an obligation to step in," Peter Fuhrman, Chairman and Chief Executive Officer of China First Capital tells VOA in an emailed response.

Others see a deeper message about Xi Jinping’s view on the role that private companies should serve broader national goals.

Howie says the probe challenges assumptions about the role of private enterprises in China.

"If anyone ever thought these companies were truly private in the sense of being independent or beyond government reach. Clearly that was never true," he says. "Everyone operates at the discretion of the Communist Party, even if you’ve done nothing wrong and clearly even if you are wealthy."